38++ Virtual currency turbotax Wallet

Home » Mining » 38++ Virtual currency turbotax WalletYour Virtual currency turbotax exchange are available. Virtual currency turbotax are a news that is most popular and liked by everyone this time. You can Get the Virtual currency turbotax files here. Find and Download all royalty-free trading.

If you’re searching for virtual currency turbotax pictures information linked to the virtual currency turbotax topic, you have come to the right site. Our site frequently provides you with hints for seeing the maximum quality video and picture content, please kindly surf and locate more enlightening video content and images that match your interests.

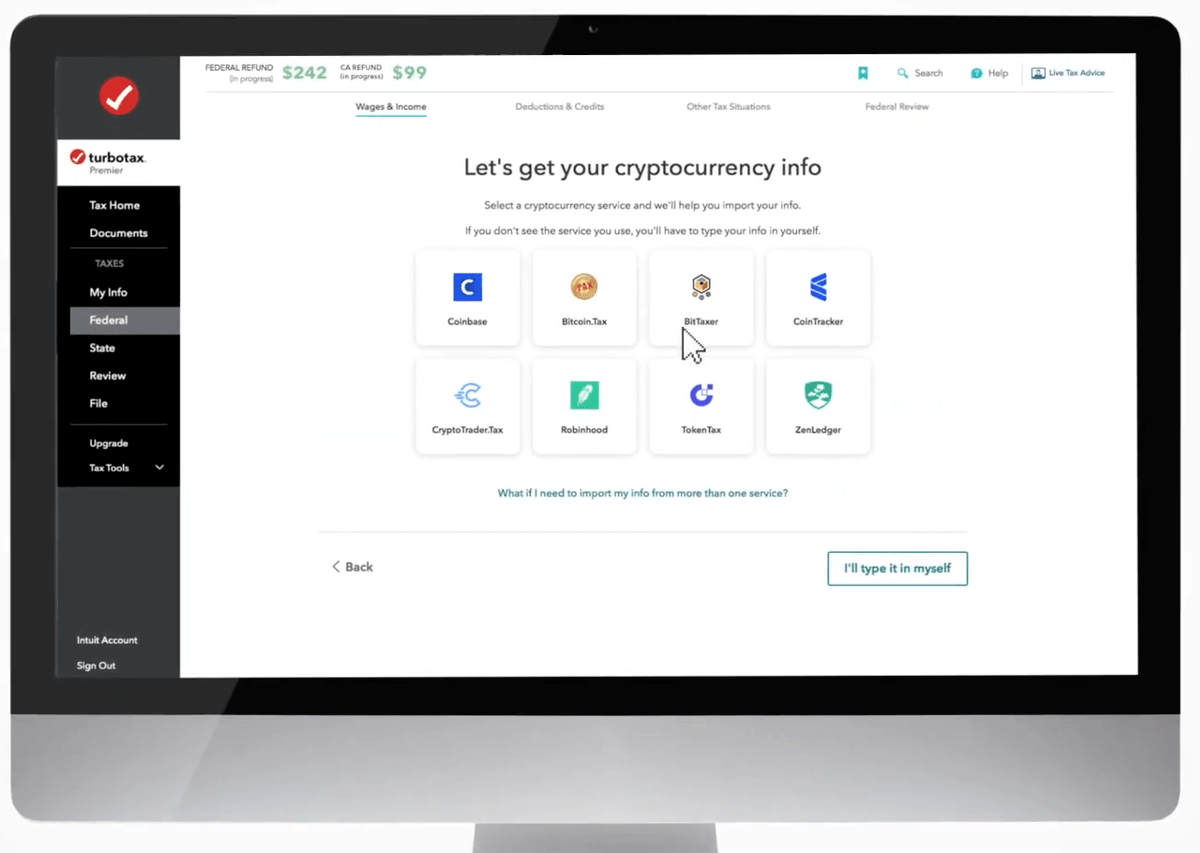

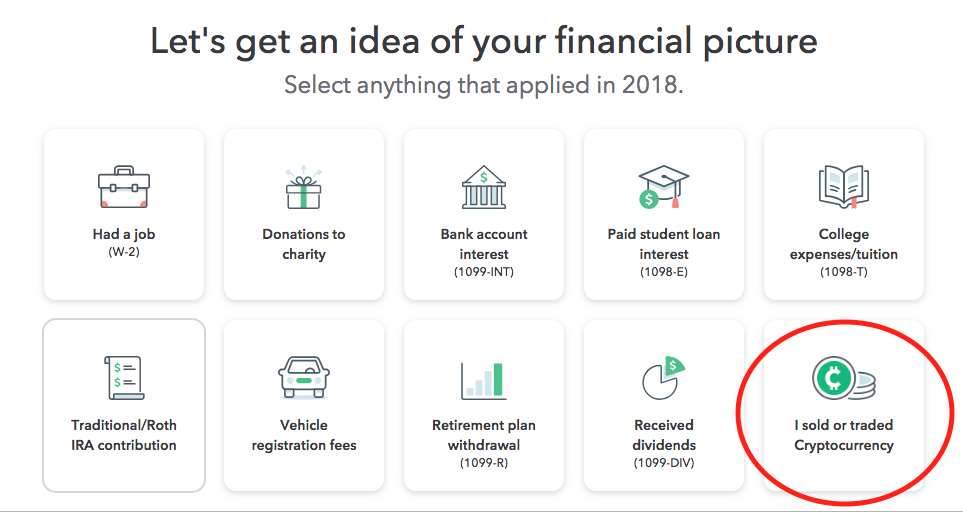

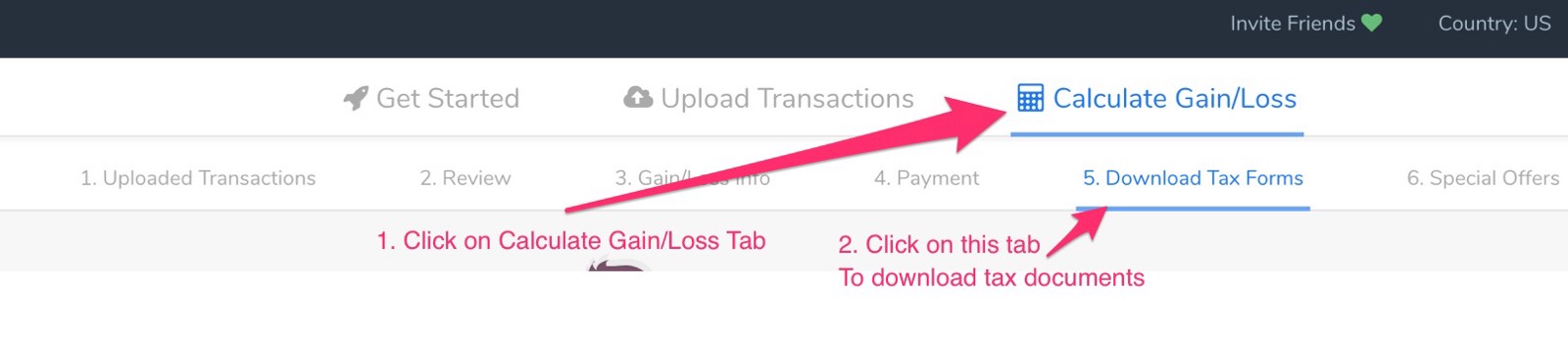

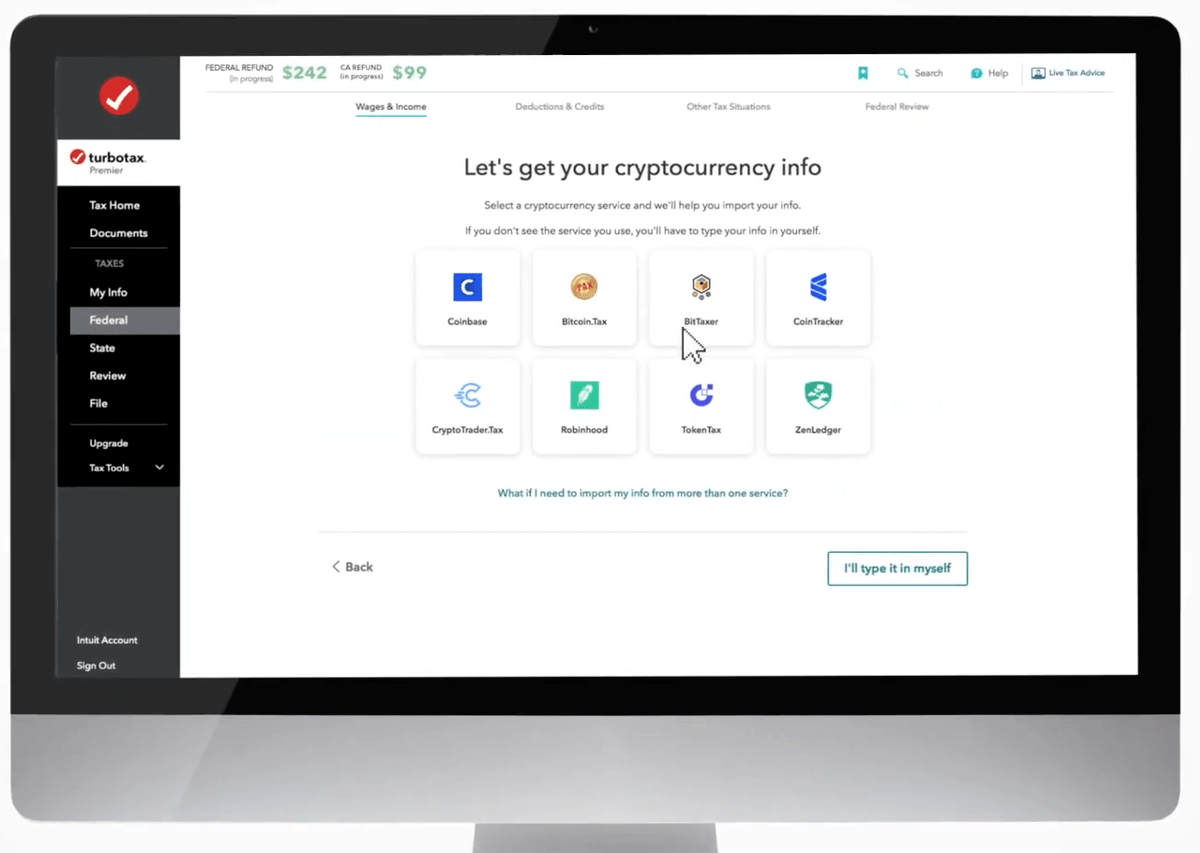

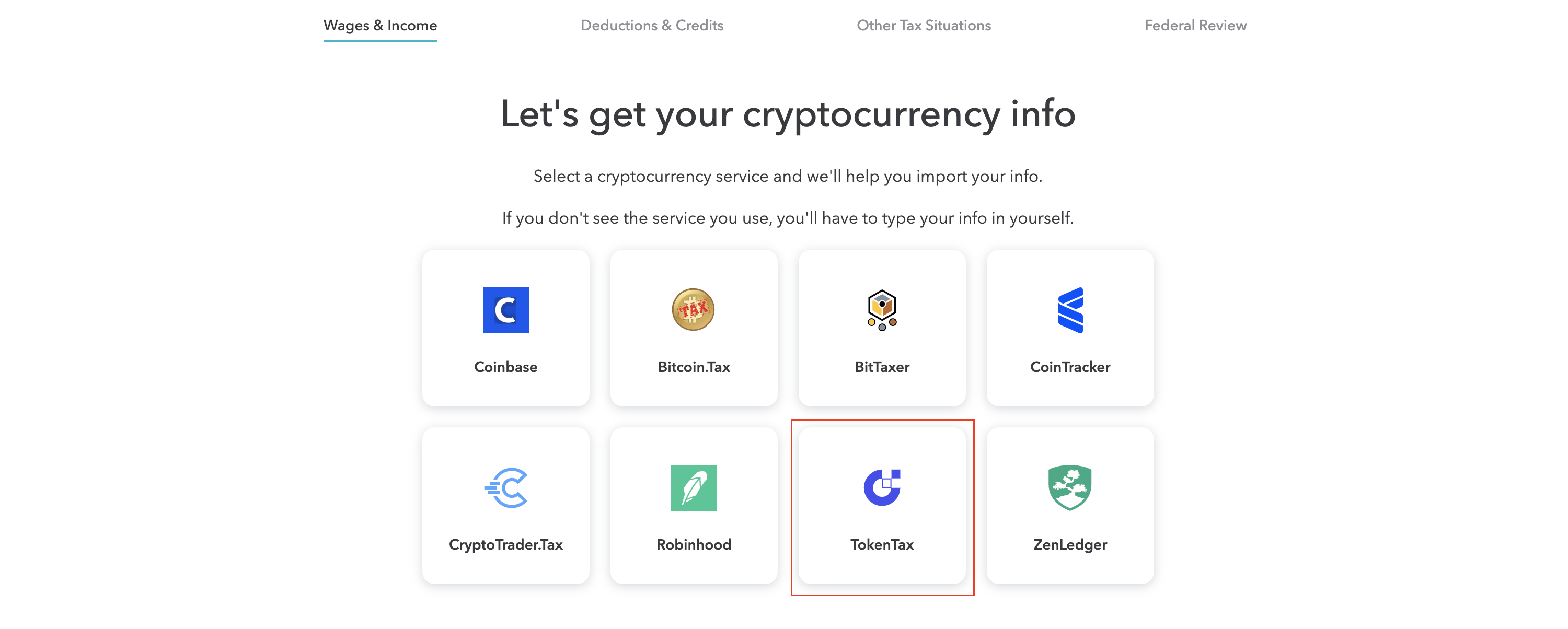

Virtual Currency Turbotax. If you are using TurboTax or any other tax filing software you should import your TurboTax CSV that CryptoTraderTax exports as well as your 1099-B that Robinhood exports into your TurboTax account. Watch how it works. 1 855-999-4499 The IRS further issued guidance on how virtual money should be taxed on October 9 2019 the remaining guidance was released in 2014 stating that virtual foreign money as an asset for federal profit tax purposes Is handled in and is relevant to the tax. It couldnt be further from the truth unfortunately.

5 Best Crypto Tax Software Accounting Calculators 2022 From buybitcoinworldwide.com

5 Best Crypto Tax Software Accounting Calculators 2022 From buybitcoinworldwide.com

Calculate your crypto taxes and file your return. The way I read the instructions see below is that Sch 1 needs to be filed regardless if the answer to the virtual currency is Yes. In this guide we walk through the step-by-step process for crypto and bitcoin tax reporting within TurboTaxboth online and desktop versions. If the response to that question is No and the taxpayer is not otherwise required to file Sch 1 nothing needs to be done and that would be an indication to the IRS that the taxpayer did not engage in any such transaction. This applies to virtual currency sales too. The IRS has made a lot of information about virtual currency and taxes available online.

1 855-999-4499 The IRS further issued guidance on how virtual money should be taxed on October 9 2019 the remaining guidance was released in 2014 stating that virtual foreign money as an asset for federal profit tax purposes Is handled in and is relevant to the tax.

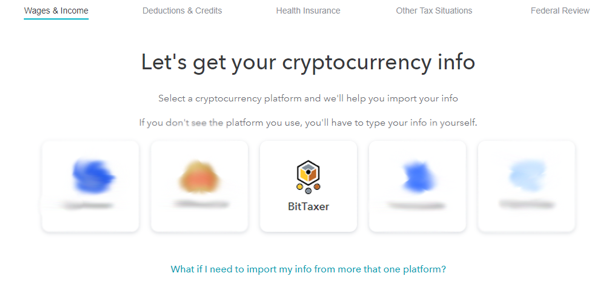

Follow the instructions and well calculate the gain or loss from the sale. Updated 1040 Virtual Currency Guidance. People might refer to cryptocurrency as a virtual currency but its not a true currency in the eyes of the IRS. This dedicated staff is constantly monitoring the site and performing internal checks and external tests. Did you buy or sell cryptocurrency tokens or other virtual currency Some coworkers think that the CRA wont find out but thats actually quite easy for them. Calculate crypto taxes for decentralized finance services like interest made from crypto lending or cToken transactions.

Source: medium.com

Source: medium.com

Virtual Currency Checkbox. If the response to that question is No and the taxpayer is not otherwise required to file Sch 1 nothing needs to be done and that would be an indication to the IRS that the taxpayer did not engage in any such transaction. If you are using TurboTax to file your taxes and only acquired crypto in 2020 with real currency but did not otherwise transact eg. Form 8949 for TurboTax. Bitcoin remains to be the most circulated and the most used digital currency today.

Source: in.pcmag.com

Source: in.pcmag.com

Follow the instructions and well calculate the gain or loss from the sale. Bitcoin remains to be the most circulated and the most used digital currency today. In this guide we walk through the step-by-step process for crypto and bitcoin tax reporting within TurboTaxboth online and desktop versions. Calculate crypto taxes for decentralized finance services like interest made from crypto lending or cToken transactions. It couldnt be further from the truth unfortunately.

Source: turbotax.intuit.com

Source: turbotax.intuit.com

Then it will be checked on Schedule 1. Virtual currency is a digital representation of value that functions as a medium of exchange a unit of account and a store of value other than a representation of the United States dollar or a foreign currency Essentially the IRS has a broad view of what classifies as virtual currency. Did you buy or sell cryptocurrency tokens or other virtual currency Some coworkers think that the CRA wont find out but thats actually quite easy for them. If youve invested in crypto long before this year and didnt report your transactions or pay any applicable taxes I recommend consulting a tax advisor to amend your returns right away. It is listed right under the instructions page of Whats new for 2019.

Source: medium.com

Source: medium.com

Im doing my taxes with TurboTax and came across a new question part of their interview step. If youve invested in crypto long before this year and didnt report your transactions or pay any applicable taxes I recommend consulting a tax advisor to amend your returns right away. Bitcoin remains to be the most circulated and the most used digital currency today. This is for Windows at least. Then it will be checked on Schedule 1.

Source: tokentax.co

Source: tokentax.co

Once you have your figures. Following article is not written by a tax professional. This language was not present in the prior instructional guidance that was released in October. This dedicated staff is constantly monitoring the site and performing internal checks and external tests. Virtual Currency Checkbox.

Source: reddit.com

Source: reddit.com

In TurboTax Home and Business the Search box is located in the grey bar below the blue bar at the top right of your screen. If the response to that question is No and the taxpayer is not otherwise required to file Sch 1 nothing needs to be done and that would be an indication to the IRS that the taxpayer did not engage in any such transaction. Jump to solution. What happens on an e-filed return I have no idea but at least if you print out the return it will be marked to protect you. It is listed right under the instructions page of Whats new for 2019.

Source: blog.turbotax.intuit.com

Source: blog.turbotax.intuit.com

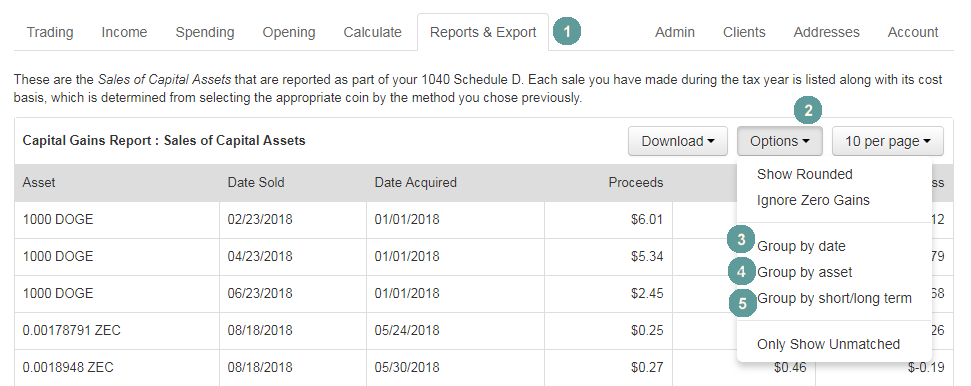

To report your taxable events calculate your gain or loss from the transaction and record this onto one line of Form 8949. Any sum of money that enters in any Canadian financial institution from. Then it will be checked on Schedule 1. Please consult a professional for your specific situation. In this guide we walk through the step-by-step process for crypto and bitcoin tax reporting within TurboTaxboth online and desktop versions.

Source: hackernoon.com

Source: hackernoon.com

Intuit Turbotax Guide to IRS Virtual Currency Taxes Toll Free Number. View Example Tax Reports. In TurboTax Home and Business the Search box is located in the grey bar below the blue bar at the top right of your screen. Virtual currency is treated as property and general tax principles applicable to property. You can check it on the 10401040SR worksheet not on Schedule 1.

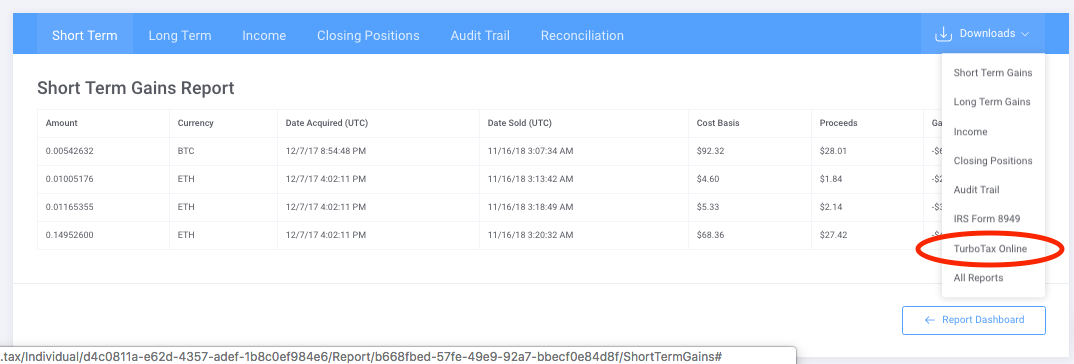

Source: bitcointaxes.zendesk.com

Source: bitcointaxes.zendesk.com

People might refer to cryptocurrency as a virtual currency but its not a true currency in the eyes of the IRS. Must file by March 31 2022 to be. The IRS looks at the character of the gain or lossyour intent or why youre selling. IRS introduced a new question on the 2019 Form 1040 about the virtual currencies read as. No data will be double counted.

Source: medium.com

Source: medium.com

When you upload both of these all of your transactions will be included within your tax return. The IRS has made a lot of information about virtual currency and taxes available online. This dedicated staff is constantly monitoring the site and performing internal checks and external tests. Follow the instructions and well calculate the gain or loss from the sale. TurboTax allows cryptocurrency users to report their cryptocurrency taxes directly within the TurboTax app.

Source: ttlc.intuit.com

Source: ttlc.intuit.com

Now this means that every time you use bitcoin it will have an effect on your tax return. What happens on an e-filed return I have no idea but at least if you print out the return it will be marked to protect you. Following article is not written by a tax professional. Updated 1040 Virtual Currency Guidance. TurboTax allows cryptocurrency users to report their cryptocurrency taxes directly within the TurboTax app.

Source: hackernoon.com

Source: hackernoon.com

Updated 1040 Virtual Currency Guidance. If in 2019 you. This means that Bitcoin has actual real currency equivalent value. To dig deeper visit this page of FAQs or read IRS Notice 2014-21. Sell exchange between virtual currencies receive crypto as payment or gift pay for something with crypto etc you should answer No to the question that asks you about cryptocurrency transactions when wrapping up the Income section in TurboTax.

Source: buybitcoinworldwide.com

Source: buybitcoinworldwide.com

Virtual currency is a digital representation of value that functions as a medium of exchange a unit of account and a store of value other than a representation of the United States dollar or a foreign currency Essentially the IRS has a broad view of what classifies as virtual currency. Youve successfully imported your cryptocurrency transactions into TurboTax and can rest assured that your capital gains andor losses will be accurately reported. Now this means that every time you use bitcoin it will have an effect on your tax return. Rated as the best crypto tax calculator. A dozen years later there are thousands of.

Source: softwaretestinghelp.com

Source: softwaretestinghelp.com

Youve successfully imported your cryptocurrency transactions into TurboTax and can rest assured that your capital gains andor losses will be accurately reported. TurboTax security specialists work with the IRS and state revenue departments to prevent fraud. Follow the instructions and well calculate the gain or loss from the sale. Virtual currency is a digital representation of value that functions as a medium of exchange a unit of account and a store of value other than a representation of the United States dollar or a foreign currency Essentially the IRS has a broad view of what classifies as virtual currency. The IRS looks at the character of the gain or lossyour intent or why youre selling.

Source: bitcointaxes.zendesk.com

Source: bitcointaxes.zendesk.com

Youve successfully imported your cryptocurrency transactions into TurboTax and can rest assured that your capital gains andor losses will be accurately reported. TokenTax is a crypto tax software platform and a full-service cryptocurrency tax accounting firm. Seamlessly import your Form 8949 into TurboTaxs cryptocurrency section for both TurboTax Web and TurboTax CD Desktop. For a step-by-step walkthrough detailing how to report crypto. Once you have your figures.

Source: blog.turbotax.intuit.com

Source: blog.turbotax.intuit.com

Offer only available with TurboTax Live Basic and for simple tax returns only. Watch how it works. TurboTax security specialists work with the IRS and state revenue departments to prevent fraud. 1 855-999-4499 The IRS further issued guidance on how virtual money should be taxed on October 9 2019 the remaining guidance was released in 2014 stating that virtual foreign money as an asset for federal profit tax purposes Is handled in and is relevant to the tax. Many people assume since cryptocurrency is a virtual currency they dont owe taxes.

Source: tokentax.co

Source: tokentax.co

The sector now had a novel asset magnificence no longer only a new virtual currency. Now this means that every time you use bitcoin it will have an effect on your tax return. This dedicated staff is constantly monitoring the site and performing internal checks and external tests. Many people assume since cryptocurrency is a virtual currency they dont owe taxes. It is listed right under the instructions page of Whats new for 2019.

Source: in.pcmag.com

Source: in.pcmag.com

If you are using TurboTax to file your taxes and only acquired crypto in 2020 with real currency but did not otherwise transact eg. If the response to that question is No and the taxpayer is not otherwise required to file Sch 1 nothing needs to be done and that would be an indication to the IRS that the taxpayer did not engage in any such transaction. Jump to solution. TurboTax allows cryptocurrency users to report their cryptocurrency taxes directly within the TurboTax app. Then it will be checked on Schedule 1.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title virtual currency turbotax by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.