19+ Turbotax virtual currency Popular

Home » Bitcoin » 19+ Turbotax virtual currency PopularYour Turbotax virtual currency news are available in this site. Turbotax virtual currency are a wallet that is most popular and liked by everyone this time. You can News the Turbotax virtual currency files here. Download all royalty-free mining.

If you’re looking for turbotax virtual currency images information connected with to the turbotax virtual currency keyword, you have visit the ideal blog. Our site frequently gives you suggestions for downloading the highest quality video and image content, please kindly hunt and find more enlightening video articles and images that fit your interests.

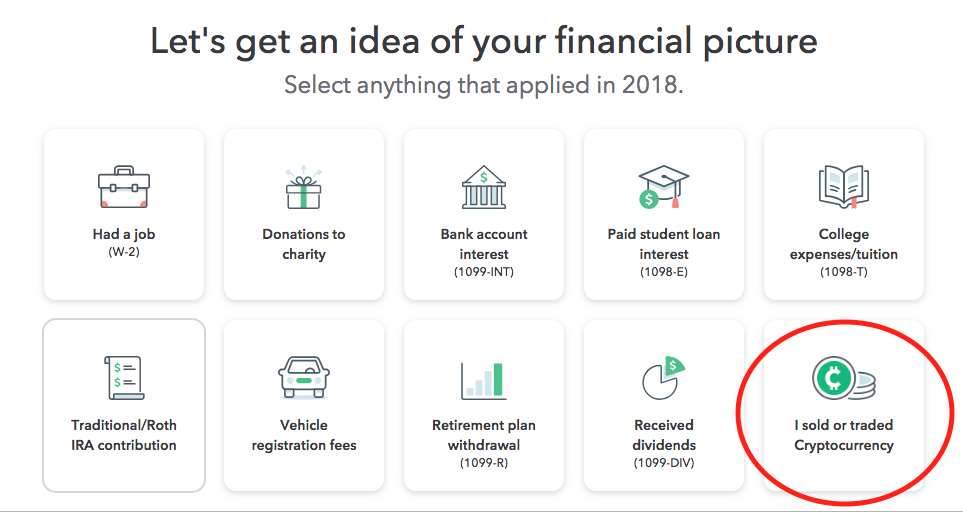

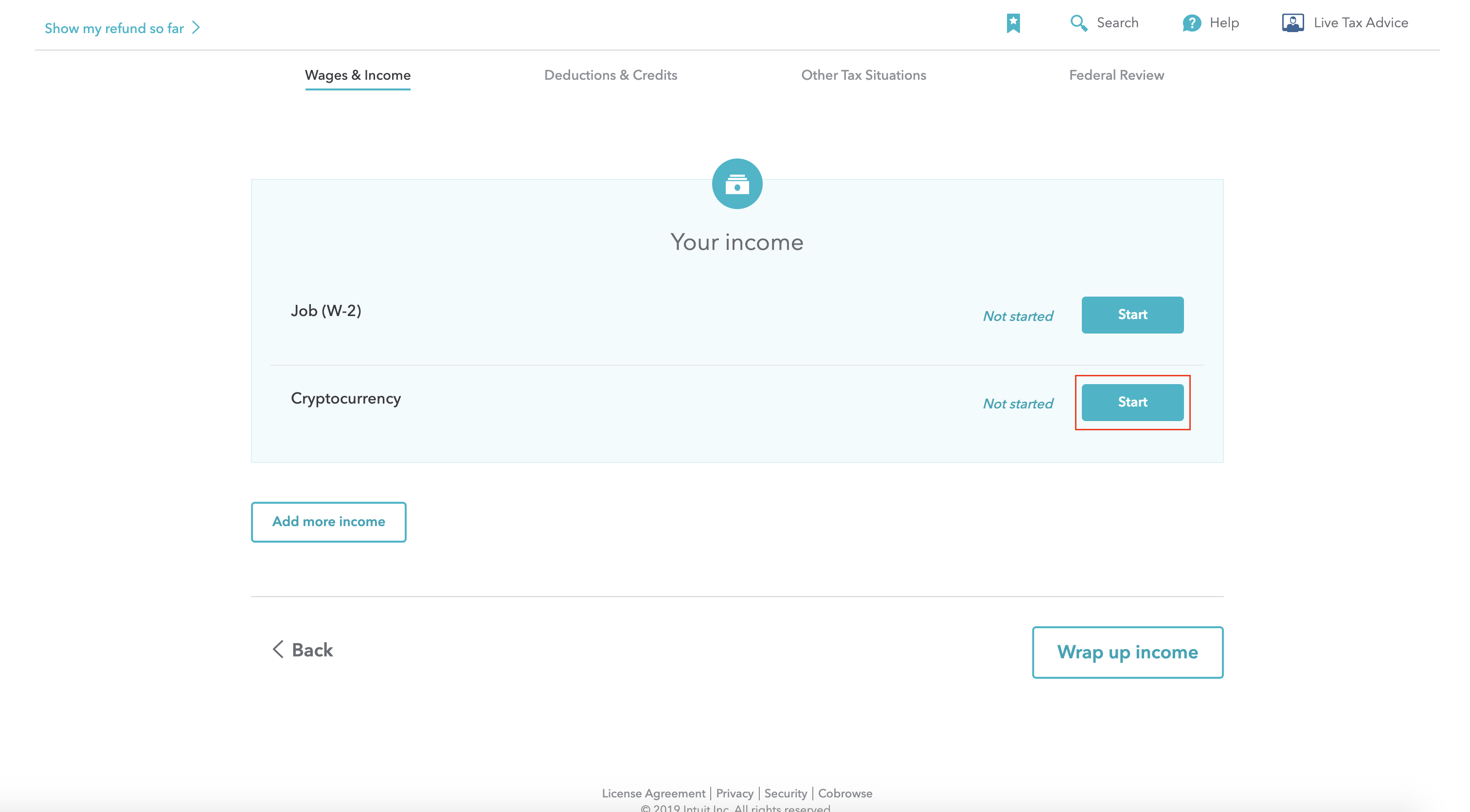

Turbotax Virtual Currency. Again this is because all of your gains losses cost. If you make lots of trades most crypto tax software will connect to your exchange accounts and import the data for you. The IRS has made a lot of information about virtual currency and taxes available online. Its main advantage among other -e-currencies is that is under the category of convertible virtual currency.

At this time you do not need to import this 1099-B into specific crypto tax software like CryptoTraderTax. Virtual currency is an unregulated form of digital representation of money held exclusive in online wallets and accounts. TurboTax allows you to download CSV files from eight cryptocurrency services. Updated 1040 Virtual Currency Guidance The new guidance now declares that those who purchased cryptocurrency in 2020 not just sold traded or exchanged must answer yes to the question. This means that capital. If youre not sure what it is its fairly safe to answer the question no for your tax return this year - all that is required is a yes or no answer to this question no additional detail is required.

Now this means that every time you use bitcoin it will have an effect on your tax return.

Sell exchange between virtual currencies receive crypto as payment or gift pay for something with crypto etc you should answer No to the question that asks you about cryptocurrency transactions when wrapping up the Income section in TurboTax. Intuit Turbotax Guide to IRS Virtual Currency Taxes Toll Free Number. Sell exchange between virtual currencies receive crypto as payment or gift pay for something with crypto etc you should answer No to the question that asks you about cryptocurrency transactions when wrapping up the Income section in TurboTax. Updated 1040 Virtual Currency Guidance The new guidance now declares that those who purchased cryptocurrency in 2020 not just sold traded or exchanged must answer yes to the question. Virtual currency is a digital representation of value that functions as a medium of exchange a unit of account and a store of value other than a representation of the United States dollar or a foreign currency Essentially the IRS has a broad view of what classifies as virtual currency. A dozen years later there are thousands of.

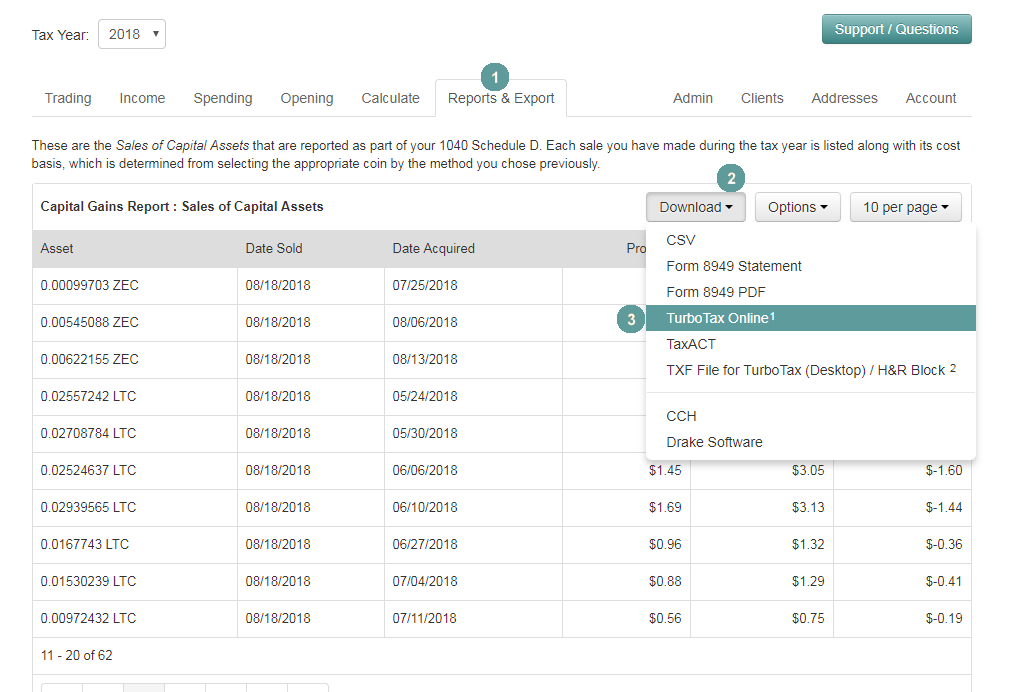

Sell exchange between virtual currencies receive crypto as payment or gift pay for something with crypto etc you should answer No to the question that asks you about cryptocurrency transactions when wrapping up the Income section in TurboTax. The IRS looks at the character of the gain or lossyour intent or why youre selling. Seamlessly import your Form 8949 into TurboTaxs cryptocurrency section for both TurboTax Web and TurboTax CD Desktop. It will also hand that information over to your regular tax software like turbotax. To dig deeper visit this page of FAQs or.

A simple tax return is Form 1040 only without any additional schedules. TurboTax allows you to download CSV files from eight cryptocurrency services. Now this means that every time you use bitcoin it will have an effect on your tax return. Virtual currency is considered property and is taxed as one. TurboTax support International support Mining CapEx FBAR support Stay focused on markets.

Source: blog.turbotax.intuit.com

Source: blog.turbotax.intuit.com

If you have a Mac look in the Topics List for the search word instead. Calculate crypto taxes for decentralized finance services like interest made from crypto lending or cToken transactions. Seamlessly track your capital gains capital losses and tax liability for every virtual currency transaction. TurboTax allows you to download CSV files from eight cryptocurrency services. Virtual Currency Checkbox.

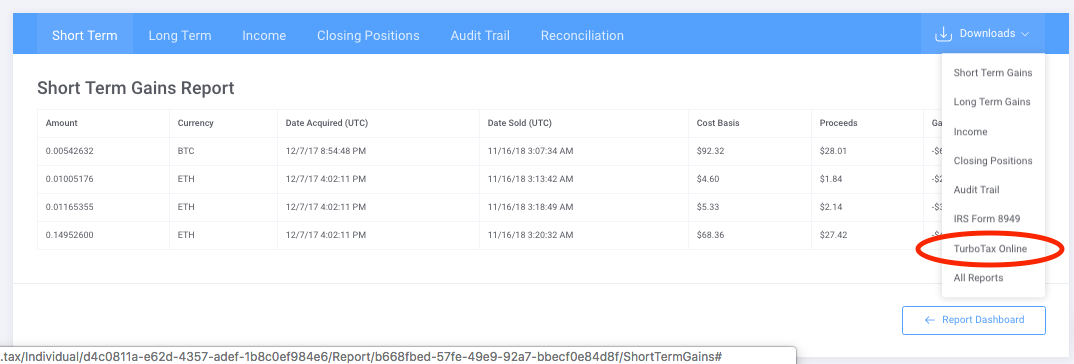

Source: tokentax.co

Source: tokentax.co

Its main advantage among other -e-currencies is that is under the category of convertible virtual currency. You can give virtual currency as a gift transfer it between wallets or exchanges and purchase it with US dollars without creating a taxable situation. Updated 1040 Virtual Currency Guidance The new guidance now declares that those who purchased cryptocurrency in 2020 not just sold traded or exchanged must answer yes to the question. If you have a Mac look in the Topics List for the search word instead. Stop worrying about record keeping filing keeping up to date with the evolving crypto tax code.

Source: in.pcmag.com

Source: in.pcmag.com

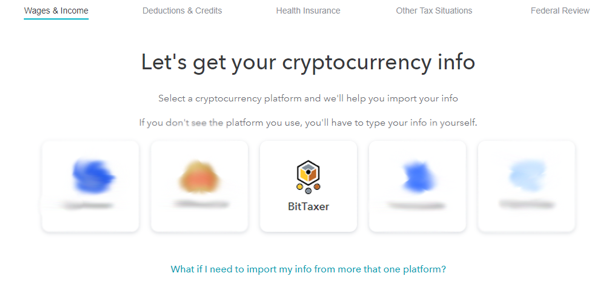

The software always supports Bitcoin Ethereum Litecoin Defi and nearly any other coin. You have investments to make. But if you. Coinbase bitcoinTax BitTaxer CoinTracker CryptoTraderTax. This dedicated staff is constantly monitoring the site and performing internal checks and external tests.

Source: softwaretestinghelp.com

Source: softwaretestinghelp.com

This language was not present in the prior instructional guidance that was released in October. Intuit Turbotax Guide to IRS Virtual Currency Taxes Toll Free Number. Form 8949 for TurboTax. Virtual currency is a digital representation of value that functions as a medium of exchange a unit of account and a store of value other than a representation of the United States dollar or a foreign currency Essentially the IRS has a broad view of what classifies as virtual currency. Stop worrying about record keeping filing keeping up to date with the evolving crypto tax code.

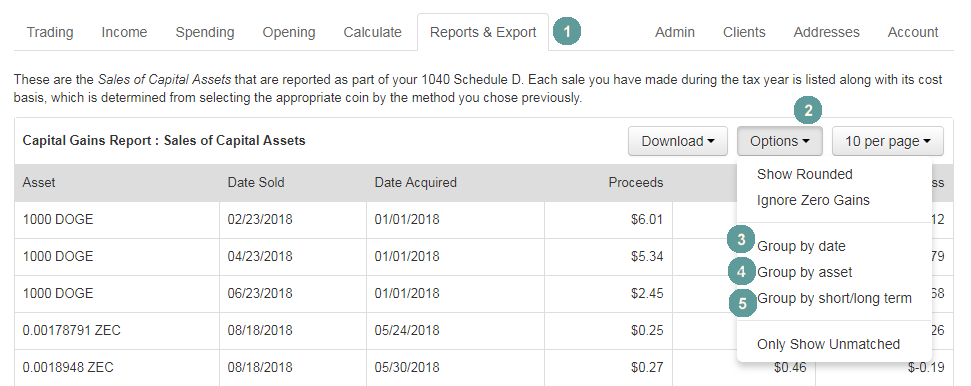

Source: bitcointaxes.zendesk.com

Source: bitcointaxes.zendesk.com

This is for Windows at least. This dedicated staff is constantly monitoring the site and performing internal checks and external tests. Seamlessly import your Form 8949 into TurboTaxs cryptocurrency section for both TurboTax Web and TurboTax CD Desktop. This language was not present in the prior instructional guidance that was released in October. This means that capital.

Source: blog.turbotax.intuit.com

Source: blog.turbotax.intuit.com

TurboTax support International support Mining CapEx FBAR support Stay focused on markets. Form 8949 for TurboTax. If in 2019 you engaged in any transaction involving virtual currency check the Yes box next to the question on virtual currency at the top of Schedule 1. If you make lots of trades most crypto tax software will connect to your exchange accounts and import the data for you. But even if the taxpayer is not otherwise required to file Sch 1 but has engaged in any virtual currency transactions as described Sch 1 will still need to be filed.

Source: medium.com

Source: medium.com

If you make lots of trades most crypto tax software will connect to your exchange accounts and import the data for you. The software always supports Bitcoin Ethereum Litecoin Defi and nearly any other coin. It asks if you received sold sent exchanged or otherwise acquired any financial interest in any virtual currency at any time during the year. Calculate crypto taxes for decentralized finance services like interest made from crypto lending or cToken transactions. If you otherwise have to.

Source: hackernoon.com

Source: hackernoon.com

Updated 1040 Virtual Currency Guidance The new guidance now declares that those who purchased cryptocurrency in 2020 not just sold traded or exchanged must answer yes to the question. This applies to virtual currency sales too. The IRS looks at the character of the gain or lossyour intent or why youre selling. Virtual currency is an unregulated form of digital representation of money held exclusive in online wallets and accounts. This dedicated staff is constantly monitoring the site and performing internal checks and external tests.

Source: ttlc.intuit.com

Source: ttlc.intuit.com

Do not understand what is virtual currency. Virtual currency is an unregulated form of digital representation of money held exclusive in online wallets and accounts. In TurboTax Home and Business the Search box is located in the grey bar below the blue bar at the top right of your screen. Do not understand what is virtual currency. Seamlessly track your capital gains capital losses and tax liability for every virtual currency transaction.

Source: reddit.com

Source: reddit.com

The sector now had a novel asset magnificence no longer only a new virtual currency. If you otherwise have to. Virtual Currency Checkbox. It will also hand that information over to your regular tax software like turbotax. Coinbase bitcoinTax BitTaxer CoinTracker CryptoTraderTax.

Source: tokentax.co

Source: tokentax.co

If in 2019 you have not engaged in any transaction involving virtual currency and you dont otherwise have to file Schedule 1 you dont have to do anything further. Bitcoin remains to be the most circulated and the most used digital currency today. If you otherwise have to. You have investments to make. Generate tax forms like the Form 8949 for your return or for import into TurboTax.

Source: turbotax.intuit.com

Source: turbotax.intuit.com

In TurboTax Home and Business the Search box is located in the grey bar below the blue bar at the top right of your screen. A dozen years later there are thousands of. If you have a Mac look in the Topics List for the search word instead. Intuit Turbotax Guide to IRS Virtual Currency Taxes Toll Free Number. If in 2019 you engaged in any transaction involving virtual currency check the Yes box next to the question on virtual currency at the top of Schedule 1.

Source: bitcointaxes.zendesk.com

Source: bitcointaxes.zendesk.com

This means that capital. The IRS has made a lot of information about virtual currency and taxes available online. 0 Federal 0 State 0 To File offer is available for simple tax returns only with TurboTax Free Edition. This dedicated staff is constantly monitoring the site and performing internal checks and external tests. 1 855-999-4499 The IRS further issued guidance on how virtual money should be taxed on October 9 2019 the remaining guidance was released in 2014 stating that virtual foreign money as an asset for federal profit tax purposes Is handled in and is relevant to the tax principal.

Source: mydealsclub.com

Source: mydealsclub.com

At this time you do not need to import this 1099-B into specific crypto tax software like CryptoTraderTax. Now this means that every time you use bitcoin it will have an effect on your tax return. TurboTax support International support Mining CapEx FBAR support Stay focused on markets. Virtual currency is an unregulated form of digital representation of money held exclusive in online wallets and accounts. This is for Windows at least.

Source: medium.com

Source: medium.com

The IRS has made a lot of information about virtual currency and taxes available online. It asks if you received sold sent exchanged or otherwise acquired any financial interest in any virtual currency at any time during the year. If in 2019 you have not engaged in any transaction involving virtual currency and you dont otherwise have to file Schedule 1 you dont have to do anything further. TurboTax support International support Mining CapEx FBAR support Stay focused on markets. A simple tax return is Form 1040 only without any additional schedules.

Source: in.pcmag.com

Source: in.pcmag.com

The IRS has made a lot of information about virtual currency and taxes available online. It asks if you received sold sent exchanged or otherwise acquired any financial interest in any virtual currency at any time during the year. 0 Federal 0 State 0 To File offer is available for simple tax returns only with TurboTax Free Edition. This language was not present in the prior instructional guidance that was released in October. If you are using TurboTax to file your taxes and only acquired crypto in 2020 with real currency but did not otherwise transact eg.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title turbotax virtual currency by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.